For investors and traders participating in the Hong Kong Stock Exchange (HKEX), it is crucial to understand the settlement mechanisms that govern transactions. One such critical mechanism is the T+2 settlement system. This blog will explore what the T+2 settlement system entails for HK stocks and how Tiger Brokerssupports traders navigating this arrangement.

What is the T+2 Settlement System?

The T+2 settlement system refers to the timeline for the settlement of financial transactions, where “T” stands for the transaction date, and “+2” represents two business days after the transaction. This system is standard practice in many global markets, including HKEX.

How It Works:

– Transaction Date (T): This is the day on which the trade is executed. For example, if you buy or sell shares on a Monday, this is considered the transaction date.

– Settlement Date (T+2): The actual transfer of funds and shares happens two business days after the transaction. Continuing with the earlier example, if the trade occurs on Monday, the settlement would typically be completed by Wednesday, provided there are no public holidays in between.

Importance of the T+2 System

The T+2 settlement system is designed to increase market efficiency and reduce risks associated with financial transactions. By allowing a two-day period between the transaction and settlement dates, it provides time for all parties involved—traders, brokers, and clearinghouses—to organize the necessary documents and funds to successfully conclude the transaction. This system also helps manage and mitigate the risks of price volatility and financial discrepancies that might arise during the settlement process.

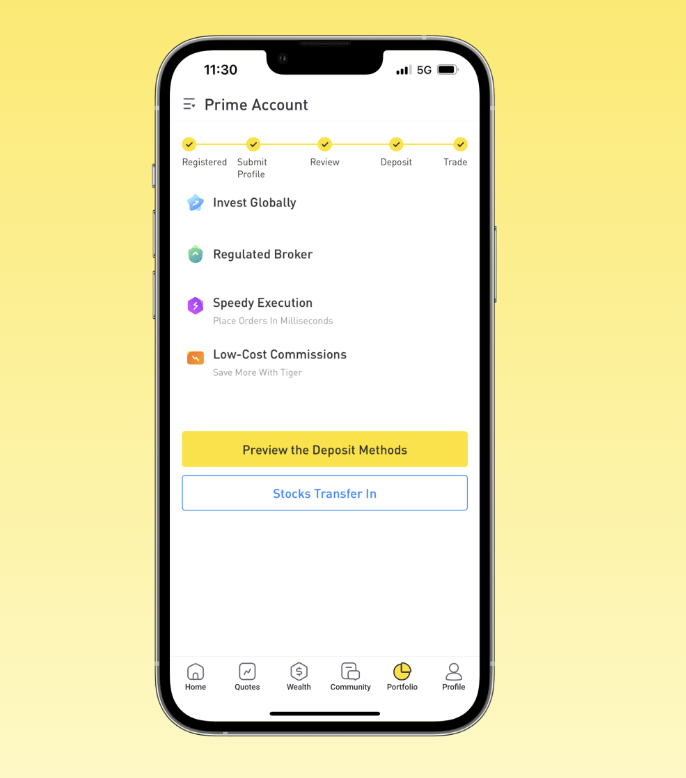

Tiger Brokers: Streamlining HK Stock Transactions

For those trading HK stock index, understanding and managing the settlement process is crucial. Tiger Brokers offers a robust platform that facilitates a smooth navigation of the T+2 settlement system. Here’s how Tiger Brokers enhances the trading experience:

– Efficient Processing: Tiger Brokers ensures that all transactions are processed efficiently so that the T+2 timeline is adhered to without delays. This efficiency is vital for traders who need to plan their financial activities around the settlement dates.

– Clear Communication: Tiger Brokers provides clear, timely updates about the status of transactions, which is essential for traders to track the progress of their trades from execution to settlement.

– Educational Resources: Understanding settlement systems can be complex for both new and experienced traders. Tiger Brokers offers educational tools that help demystify the T+2 system, explaining its implications for trading strategies and financial planning.

– Advanced Tools: The platform includes features that allow traders to manage their portfolios effectively, taking into account the timing of settlements. These tools help traders ensure that they have the necessary liquidity to meet their trading needs.

Conclusion

The T+2 settlement system is a fundamental aspect of trading HK stocks, ensuring that transactions are settled efficiently and securely. By providing a buffer period, it helps maintain market stability and reduce transactional risks. Platforms like Tiger Brokers play a crucial role in supporting traders through these processes, offering tools and resources that ensure compliance with settlement norms while enhancing the overall trading experience. Understanding and efficiently managing the T+2 settlement process is essential for anyone engaged in the HKEX, and Tiger Brokers is equipped to facilitate this with precision and user-friendly services.